The people of this country have been the target of the most insidious and pervasive form of propaganda, non-stop, for the last 50 years. And, perhaps the worst part is that our government has been complicit in allowing it to continue because, at least in part, our government has been a beneficiary of what’s been accomplished.

Americans are saddled with astounding amounts of credit card debt and today, roughly 80 percent of Americans have at least one credit card… 15 percent have more than 10. According to data released by the American Bankers Association in May of 2021, there were 365 million open credit card accounts at the end of 2020 in the U.S.

The propaganda campaign we’ve been subject to might be referred to in any of the following ways:

Debt is a status symbol… debt is a sign of success… debt is cool… you should want as much debt as you can get… being approved for more debt means you’ve made it.

Look at that handsome man getting out of that expensive car with that beautiful girl by his side… look… he’s paying for dinner with his striking sign of success… his GOLD Visa Card.

And how about… Rescue a Puppy… $22. Puppy’s bowl… $8. Pictures of your baby with the puppy… Priceless. Some things money can’t buy. For everything else there’s MasterCard. Look at the puppies and the baby… awwwww… how cute!

The fact is that you can’t get through an hour of your day without being exposed to very sophisticated advertising that is expertly designed to position debt as s status symbol… something to be desired… to aspire to.

I want to be a gold debtor… I want to be a platinum debtor… how about a silver card? Can I be a titanium debtor? I’d like to see something in a palladium card. Why not become an emerald debtor, or perhaps a sapphire debtor? I want the Purple Card… can I have the purple card, please? Wait… I love to Discover! Or, I want to be a “Member”. I want privileges.

Want to know what those ads should say? How about the following:

Can’t afford stuff? Order your CEMENT VISA. Or… Get your GRANITE MasterCard. Lug either one of those around with you wherever you go and everyone will know that you don’t make enough money to support your lifestyle. Call 800-GET-DEBT… that’s 1-800-GET-DEBT. Call today!

Gee… I wonder why they don’t use that approach?

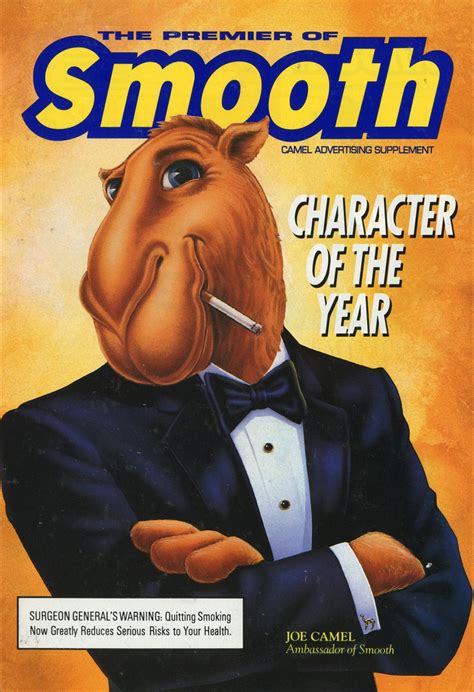

There’s another American industry that tried to use the same sort of image enhancing approach to promote its products… the tobacco industry.

See that ruggedly handsome man on that beautiful horse in the snow? He’s a Marlboro Man. Don’t you want to be a Marlboro Man, too? And what about that great looking couple on that sailboat… they look like JFK and Jackie… and they’re smoking Salem. Want to be like them? Of course you do.

Those, and many more, used to be cigarette advertising on television in this country, until in 1970, our government stepped in and said… Nooooooo. You can’t do that… cigarettes are bad for you… they’ll kill you. So, no more cigarette ads on T.V. because obviously it isn’t safe to subject a population to that sort of propaganda… they’ll be helpless against it and will die young as a result.

And I agree with that thinking. It’s not a good idea to allow the makers of cigarettes to advertise their products in such a way that millions would be persuaded to smoke and do significant harm to their health as they try to live up to glamorous images presented in one way or another on T.V. There’s nothing glamorous or cool about smoking cigarettes.

But, I’m wondering… which do you suppose kills more people each year? Smoking cigarettes… or living a lifetime with the stress brought on by the mountain of debt we’ve been enticed to take on?

Well, a significant number of researchers have shown that as much as 60-90% of illnesses are directly caused by or exacerbated by stress. And in fact, numerous studies have shown that stress is related to major illnesses like heart disease, high blood pressure, and diabetes.

Consider the following…

“A 1998 survey of 526 Japanese men, aged 30 to 69, supported the idea that long working hours can be hazardous to a man’s health. The subjects of the study included men who had been hospitalized with a heart attack as well as healthy men of similar ages and occupations. The results were striking: men from both groups who put in more than 11 hours of work on an average day were 2.4 times more likely to have a heart attack than were men who worked “just seven to nine hours a day.”

“Susan A. Everson and her colleagues at the University of Michigan School of Public Health reported that hostility increases a patient’s risk of stroke. The effect is significant. In a seven-year study of more than 2,000 men, the scientists found that men who showed high levels of anger on standard tests of anger expression were two times more likely to have strokes than were their calm peers. Other factors such as age, smoking, high blood pressure, excessive alcohol consumption, diabetes, obesity and high cholesterol levels did not account for the increased risk.”

“There is now little question that stress can kill. Harvard physiologist Walter Cannon recognized 90 years ago that when confronted by a threat-physical or emotional, real or imagined-the body responds with a rise in blood pressure, heart rate, muscle tension and breathing rate. We now know that this physiological “stress response” involves hormones and inflammatory chemicals that can foster everything from headaches to heart attacks in overdose.”

And, now a word from our sponsor…

So, while television commercials advertising cigarettes as being desirable were banned decades ago, no one seems to mind the non-stop barrage of ads that distort the image of debt, transforming what was once considered a burden, into a supposed status symbol and sign of one’s success.

Turn “Joe Camel” into a cute stuffed animal and every parent goes berserk, but hand out coolie cups and tee shirts emblazoned with the logos of Visa and MasterCard at college fairs, and no one says a word. Look Dad, I’m pre-approved.

It’s obvious that our government could care less if we die early as a result of the stress that results from living under a mountain of debt… as long as we don’t smoke.

So, what happened here? The last generation didn’t brag about being in debt, so why do we? I used to carry an American Express Platinum Card around, at the time paying a $300 annual fee for the privilege, and now I think I should have taped it to my forehead so everyone could see how successful (or stupid) I was.

Well, it’s the advertising… no question about that, but why and when did it start is an interesting question.

Credit Cards… A Walk Down Memory Lane

Bank of America introduced the nation’s first general-purpose credit card in 1958. The idea was to tap into the pent-up consumer demand created by World War II. When a bank executive was asked why he thought credit cards would be successful with consumers he said:

“Look, we just put five years of our life in a brown suit carrying an M1 rifle, and we want the refrigerator now.”

Bank of America launched their first card by mailing 60,000 cards to residents in Fresno, California, and before long, banks from all over the country were using credit cards to compete for new customers.

(Get out of debt without bankruptcy? Maybe you can… CLICK HERE.)

Prior to that, Americans were used to having a small number of banks in their small town. If they needed to borrow money, they’d go meet with the banker and he’d either grant them credit or he wouldn’t.

The first decade of credit card marketing was chaos. Some people were outraged at how banks were luring people into debt and the banks were hit by huge losses from defaults. It was 1966, however, when the fit hit the shan.

It’s referred to as “The Chicago Debacle,” and it happened in 1967, when a whole bunch of Midwestern banks decided that they each wanted to be the first to reach the huge, untapped Chicago market of shoppers in advance of that year’s holiday season.

In the rush to be first, the banks mailed credit cards to convicted felons, toddlers, and dogs… pandemonium soon ensued. The nightly news ran stories about corrupt postal workers feeding stolen cards to organized crime, while suburban families, who had never even received their cards, started receiving bills for thousands of dollars for charges they never made.

At the Congressional hearings that resulted from The Chicago Debacle, some said credit cards should be made illegal.

Fast forward to the 1970s…

The year was 1980 and South Dakota’s economy was in absolutely terrible shape. Among other things, the cost to ship wheat had jumped to almost 50 cents a bushel, and with wheat itself only selling for $2.20 a bushel, it was bankrupting much of the agriculture dependent state.

At the same time, Citibank was going broke because, of all things, its credit card business.

If you remember 1980, then you remember double-digit inflation, and the rate of inflation was exceeding the rate of interest that Citibank was legally permitted to charge its credit card customers under New York’s usury laws; laws that limited the amount of interest that could be charged on a loan.

Lending at 12 percent, while borrowing at 20 percent isn’t really much of a business model, right?

Citibank saw an opportunity in South Dakota. They flew out to meet with the state’s Governor and made a deal. South Dakota agreed to quickly pass legislation (that was actually drafted by Citibank) and it eliminated all usury laws. In other words, you could now charge as much interest as you wanted to. No more limits.

As a quid pro quo, Citibank moved its credit card operations to South Dakota, bringing 3,000 high-paying, white-collar jobs to the state. In the years since, South Dakota has collected more than $730 million in bank franchise taxes from Citibank alone.

(The move by Citibank was also made possible by a Supreme Court ruling in December of 1978, known as the Marquette Bank Opinion, which permitted national banks to charge interest rates on consumer loans based on the laws of the state where the credit decisions were made.)

The alliance between South Dakota and Citibank cleared the way for Citibank to turn their credit card operation that was losing money into an immensely profitable business. And, for years, Citibank executives could be heard saying that “South Dakota saved Citibank.”

South Dakota wanted to become the financial capital of the country, but Delaware passed similar legislation the following year and Chase, Manufacturer’s Hanover and Chemical Bank all went to Delaware, darn the luck, and ever since then, South Dakota has had to rely on roadside attractions like the Corn Palace for its notoriety.

The ability to charge interest rates that exceeded the rate of inflation made the credit card business quite profitable, rates started at 18% and went up from there. But, Ronald Reagan and his Treasury Secretary Paul Volker reined in the inflationary spiral that had gripped the nation throughout the 1970s, and as a result the Federal Reserve soon lowered the rates it charged banks.

But, we didn’t even notice…

The banks were both surprised and thrilled to learn that Americans just continued paying the 18% plus rates on their credit cards without saying a word about it. We didn’t complain, so they kept charging the high rates and making a killing. Why not?

By 1990, the number of credit cards in use more than doubled, credit card spending increased by more than five-fold, and the average household credit card balance went from $518 in 1980, to nearly $2,700, by 1990.

The cost of money was falling while average balances were climbing, and bank executives were laughing all the way to the… no, come to think of it, that’s not all that funny a phrase, now is it?

Then came what the industry referred to as “The Big Scare”.

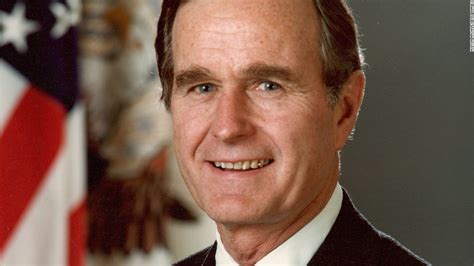

It was 1991, and President George Herbert Walker Bush was at a fundraising luncheon in New York, when an aide made a last-minute addition to a list of stimulus policies the president was to propose during his speech. President Bush said:

“I’d frankly like to see credit cards rates down. I believe that would help stimulate the consumer and get consumer confidence moving again.”

The following day, Senator D’Amato, who had never liked the ten-point spread between the prime rate and the rate credit card companies were charging customers, proposed national legislation to cap credit card interest rates at 14%, and after just 30 minutes of debate, the Senate voted 74-19 to APPROVE the measure.

PANIC ON WALL STREET!

Panic swept through the banking industry, and the stock market plunged, which had the desired impact on Washington D.C. Within days, Vice President Dan Quayle, while being interviewed on television said that if the bill passed the House the President would likely veto it… and that was the end of that.

The credit card industry dodged a bullet there, but they weren’t going to be caught flat-footed again, and the computer revolution that was taking place at that time helped. Instead of charging a straight up 18% on their cards, they would come up with more complex ways of charging customers, thus making it much harder for Washington politicians to target their profits when times were bad.

By using the new computing power, the credit card companies were increasingly able to track and interpret consumer behaviors, and by adding in variables like credit scores and other financial data, they no longer were stuck with offering a generic card at a generic rate, but now they could offer different rates to different customers.

More attractive terms could now be used to lure in the customers a given bank wanted, while other customers, especially those who had missed a payment or two, could be gouged with exorbitant rates and fees. Predictably, profitability skyrocketed.

One of the things customers valued most was a higher credit line, and the higher the better. And the banks started marketing the idea that the higher the credit line, the more successful and prosperous the individual, even though, upon reflection, it is a preposterous idea.

So, if that’s what the people wanted, that’s what they’d get: higher credit lines.

The banks very cleverly saw that one way to increase an individual’s credit line, was to decrease the required minimum monthly payment, and this increased revenues in a couple of ways.

For one thing, by reducing the minimum monthly payment, the card holder… or let’s call him or her a debtor, since that’s what he or she is… would take longer to pay off whatever balance was left on the card, which in turn would generate more interest income for the bank.

And for another, the debtor could take on more debt for the same minimum monthly payment.

So, here we all were… we’d get a letter in the mail telling us that because we’re such a highly valued customer, such a successful individual… our minimum monthly payment had been reduced, and our credit limit raised. We’d puff out our chests, strut around the living room a bit… oh yeah… Citibank just raised my limit to twenty grand, and all I have to pay is a couple hundred bucks a month.

They made us feel like kings and queens, while we should have realized that all they were doing was playing us for suckers, saying “no thank you” to such offers.

Here’s the math, and watch how cool this works…

Cut the minimum monthly payment from 5% to 2% of the balance, and you can increase the credit line from $2,000 to $5,000… and still have the same $100 minimum monthly payment! Five percent of $2,000 is $100… and two percent of $5,000 is also $100. Simple math.

We allowed ourselves to be flattered into taking on greater amounts of debt, while we ignored the “grocery store math,” that was taking us down.

Two percent is today’s standard minimum monthly payment, which is a beautiful thing if your goal is to obscure the true cost of debt in order to convince your customers to dig even deeper holes.

Unquestionably, it’s a strategy that has worked very well, because average household credit card debt, which was $2,500 in 1990, is now roughly $7,500, and it shouldn’t be difficult to imagine that higher balances mean more late payments and other penalty fees, which is precisely where the credit card industry looked for its next windfall.

In fact, many banking industry executives readily admit that, under today’s rules and terms, when people get behind on their credit card payments it becomes harder and harder to catch up.

Another Supreme Court ruling, this one in 1996, took the lid off of the amounts that could be charged as penalty fees, and they immediately went from being in the $5 – $10 range, to being $29 or $39. Today, such fees and charges add up to more than $12 billion annually.

And, banks have even been known to schedule payment dates on Sundays or on holiday weekends, just to increase the likelihood that their customers will pay late, or go over the limit. Industry reports show that the average prime customer will incur one late fee a year; the average sub-prime customer will pay two and a half.

But, going over your limit, or incurring a late fee, even with another lender, means more than just paying one fee. The banks also will increase your interest rate, saying that such behavior places you in a higher risk category. And some customers report interest rates being increased five-fold after making just one late payment.

The plot thickens…

Harvard professor, consumer advocate and bankruptcy expert, Elizabeth Warren explains that bankruptcy isn’t caused by spending sprees, it’s much more likely caused by illness, job loss, or divorce. But, it’s credit card debt that often tips the scales.

It’s a fabulous business model… you simply give out the cards to anyone and everyone, flattering them with letters that talk about them as being such good customers, so credit worthy, so successful. You get their balances up by reducing the minimum monthly payment required… then you just wait for life events, like a job loss, a divorce, an illness… and WHAM! Interest rates jump up, late fees get shoveled on… and ka-ching… it’s bonus time!

Then when someone really gets in trouble people get to sit around and criticize them for getting too far in debt. But I was a Gold Debtor… doesn’t that count for anything? No, now you’re a lead deadbeat… shame on you… what were you thinking? Puppies… I was thinking about puppies… what happened to the puppies and the babies… what about my membership and its privileges? That’s 39% of $7,500… plus late fees and over limit fees… is this a great country or what?

(Get out of debt without bankruptcy? Maybe you can… CLICK HERE.)

So, credit cards are here to stay. They started to take hold of our lives in the early to mid-1980s, and they’ve never let go. But, they couldn’t have done it alone… they needed one more thing to help them along… it’s called “securitization.”

The year that credit card debt was first securitized was 1986…

Securitization is about creating debt securities, called bonds, whose payments of principal and interest come from the cash flows that are generated by separate pools of assets… called loans.

Just like we now should understand how banks securitized home loans, credit card companies are able to use the securitization process to attract more capital, provide more credit, and manage their balance sheets by selling off the debt for cash that can be lent out again.

In 1970, securitization was nonexistent. Securitization didn’t take place earlier because of legal and regulatory barriers that had been changed by 1986. In fact, much of the growth of Wall Street’s investment banks, and the salaries of Wall Street’s bankers, has had nothing to do with the stock market… it’s been the result of the enormous profits made possible by securitization and the bond market.

Securitization was (and is) like turning lead into gold… even our government couldn’t help but get in on the act… doing whatever they could to make sure that Wall Street grew as fast as our indebtedness… with no concern as to how that debt would impact our health or our lives.

It’s all fine… as long as we don’t smoke.

Mandelman out.

When debt becomes a problem, don’t panic… and watch this video before you do anything else.

One Response