Over the last 12 years, Maine attorney, Thomas Cox has changed how foreclosures happen… or don’t, in the state of Maine. He’s definitely one of the superstars from the last housing meltdown and he’s still representing consumers today. When it comes to problems with mortgages, Tom is as good as one gets.

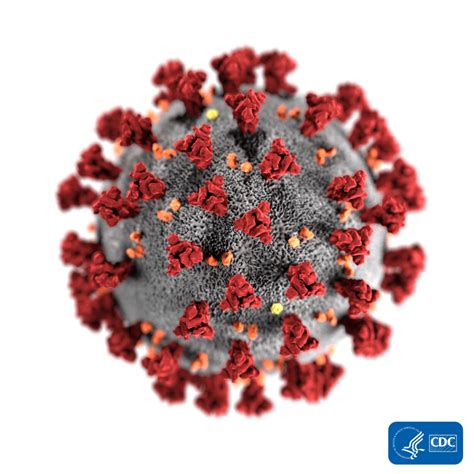

When Tom heard about millions of homeowners being granted forbearances, meaning they wouldn’t have to make their mortgage payments as a result of the Covid-19 pandemic, his reaction was a lot like mine was… Uh oh, this looks like it’s going to create a very real and very large problem.

As of the end of May, there were 4.7 million mortgages in forbearance. Today, that number is almost certainly close to 5.5 million… and it’s rising. That’s at least 10 percent of all mortgages in the U.S.

The forbearance “solution” started with the CARES Act, passed in response to the Covid pandemic, that provided for Fannie Mae and Freddie Mac owned loans to be placed in forbearance for six months, with the option to extend another six months. The rules changed around quite a bit in the early days, but as of today, if the mortgage is owned by Fannie or Freddie, the rules say that at the end of the forbearance period, the amounts owed would be added to the back end of the loan and would accrue no interest.

But, that’s ONLY if the loan is owned by Fannie Mae or Freddie Mac. Other loans could also be placed into forbearance, but no rules for how these forbearances would be handled.

What if you accept a forbearance and don’t make your $2,000 a month mortgage payments for six months? At the end of the six month forbearance, you’ll owe $12,000 in back payments and the question is… what happens next? Will your bank or servicer agree to put the $12,000 onto the back of your loan at 0% interest? And, will you have to “qualify” for such treatment? What if your income hasn’t returned to pre-Covid levels?

Again, if your loan is owned by Fannie Mae or Freddie Mac, that’s what’s supposed to happen. But, if it’s not a Fannie or Freddie loan… then there are no rules and no one knows exactly what will transpire as a result of a forbearance.

To be blunt, I’m both suspicious and very concerned. So, I asked Tom to discuss the subject and he graciously agreed. Click PLAY below and you’ll hear Tom and I talk about the mortgage forbearance issue… you don’t want to miss it… it could save your house from foreclosure someday. And be sure to look for my next article, which will have addition details.